Hello there,

Have you heard the news about how by 2027, around 100 million Indians are expected to have more than $10,000 per person? It caught my attention, and I decided to dig into the report from Goldman Sachs that talks about how they figured this out. In this newsletter, I want to break down the report for you and share what we, as regular people and potential investors, can learn from it. Let's explore together and see how it might affect our money decisions.

Before we jump into what might happen in the future and the assumptions being made, it's crucial to take a look at where we are right now and what exactly "Affluent India" means in the first place.

In simple terms, when we talk about 'Affluent India,' we're referring to a specific group of people in the country. These are individuals within the working-age population, and each person in this group earns more than approximately US$10,000 per year. This is significantly higher than the average income in India, which is around US$2,100 per person annually. So, 'Affluent India' essentially represents those with a much higher-than-average income in the working-age population.

In 2022, there were around 44 million individuals in this group, and by considering the total population, this number might go up to around 60 million.

Now, this group of around 60 million people has a significant impact on the use of various products and services in India. For instance, about 40 million people in 'Affluent India' choose to travel by air each year. Additionally, approximately 30 million of them regularly use online food delivery services, there are 30 million broadband connections and around 26 million people from this group travel internationally.

So, the main idea here is that this specific group, 'Affluent India,' not only represents a sizable number of individuals (around 60 million) but also significantly influences how various products and services are used in the country. The examples given, like air travel, online food delivery, broadband connections, and international travel, show the impact of this group on different aspects of consumption in India.

In exhibit 7, you can check that the highest 4% of working-age people in India make more than $10,000 per year each. But if you look down, almost half of the population earns less than $1500, which is around INR 1,20,000-1,50,000. In my opinion, we should pay more attention to improving this situation because if we make progress here, India could achieve amazing things.

Now, some may be curious about why people worldwide are so optimistic about India and if any indications show India has proven or is on the path to becoming "Affluent India." Goldman Sachs has provided clear answers to all these questions in their article.

According to the Goldman Sachs research report, Over the last three years, the value of both money-related assets (like stocks) and physical assets (like gold and property) in India has gone up a lot. This increase is making a big impact on the wealth of people in 'Affluent India,' creating what we call a "wealth effect."

The three main types of assets that have become more valuable from 2019 to 2023 are:

Equities (Stocks): The value of stocks has increased a lot.

Gold: The value of gold has also seen a significant rise.

Property: Although property prices have gone up too, the rate at which they have increased has been a bit higher in the last 3-4 years.

Let's take a closer look at these three types of assets, starting with Equities, which is the Indian Stock Market.

The Indian stock market has become much bigger and more valuable. In fact, from January 1, 2020, to January 1, 2024, the overall value of the Indian stock market, known as its "market cap," has gone up by a whopping 80%. This growth is significant and happened after a dip caused by the initial disruptions of COVID.

Here's an interesting fact: more regular people, not just big investors, are getting involved in this market. The number of Demat accounts has jumped from around 41 million in 2020 to about 114 million in 2023. This suggests that a lot more individuals are now interested in buying and selling shares.

Another exciting thing is that people are putting more of their savings into shares. This flow of household savings into the stock market has been consistently high since 2017. It seems like many Indians are choosing to invest in the stock market, especially during times when the market is performing well.

And here's a recent achievement: India has now become the world's fourth-largest stock market, surpassing Hong Kong. This means that the Indian stock market is now even more significant on a global scale.

Shifting our attention from equities, let's now explore the second asset class that holds a prominent position in Indian households - Gold.

So, here's something fascinating: Indian households collectively own a massive amount of gold – around 25,000 tons! To put it in perspective, that's about 10-11% of all the physical gold in the whole world, according to the World Gold Council.

Now, the interesting part is that the price of gold has been going up. In January 2020, the average cost for 10 grams of gold was about Rs39,900, and by December 2023, it had jumped to an average of Rs62,200. That's a pretty significant increase – around 65%!

Because of this rise in the price of gold, the total value of all the gold owned by Indian households has shot up from US$1.1 trillion to US$1.8 trillion between 2019 and 2023. That's a huge increase, and it's playing a big role in making 'Affluent India' even wealthier.

In simple terms, the fact that Indian households own a lot of gold, and the value of that gold has gone up, is making the wealth of 'Affluent India' rise even more.

Moving on from talking about gold, let's now look at the third type of asset - Real Estate.

So, when we talk about property prices in India, they haven't gone up as quickly as the prices of gold and stocks, but there's still something noteworthy happening. In the last few years, the speed at which property prices are increasing has changed.

Here's the scoop: On average, property prices in India have gone up by about 30% from the financial year 2019 to 2023. To put it into perspective, in the previous four years, from 2015 to 2019, the increase was much slower, only around 13%.

In simpler terms, while property prices haven't skyrocketed like gold and stocks, there has been a noticeable shift in the pace at which they are going up. The last few years have seen a faster increase in property prices compared to the earlier period.

Now that we've covered the different types of assets, let's shift our focus to the last segment of this discussion which is growing consumption. We'll explore which companies are likely to grow based on Goldman Sachs' insights

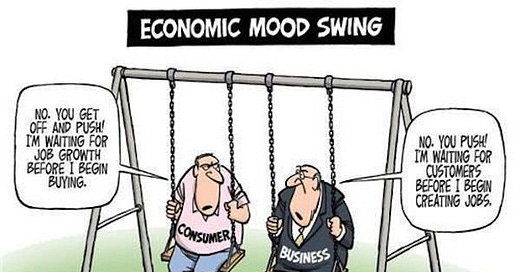

As people start earning more and more consumption and spending will be seen in the market which will directly result in the growth of the economy and GDP of India.

Goldman Sachs created a very informative table representing some of the sectors on which they are bullish.

Please note that the listed companies are not recommendations. The intention behind mentioning these companies is to illustrate that these are sectors and businesses that can potentially benefit from the rise of Affluent India.

Now, let's switch gears and move on to the list of recommendations.

My first recommendation this time is a book I read as my first book of 2024. It's called 'How Leaders Decide' by Harjeet Khanduja. This book is one of the best business books I've come across. Harjeet, who is quite experienced, has shared all his knowledge and insights in this book. It's a great mix of theory, practical advice, and real-life examples. It's an amazing book, so I recommend giving it a read.

There's a recent movie out called 'Merry Christmas' with Katrina Kaif and Vijay Sethupati. If you haven't seen it yet, I highly recommend it; it's a fantastic film. I've got another movie suggestion for you, it's called 'The Outfit.' It's a great film that starts a bit confusing in the first half, but as you reach the end, it turns out to be one of the best movies. Give it a try!

In conclusion, I have tried to explain why India matters a lot around the world and is a good spot for both big and small investors. I hope you found this read interesting. Share your opinions about Affluent India in the comments, and don't forget to watch Nikhil Kamath’s(co-founder of Zerodha) video on India's significance in a recent event. Thanks for reading!

amazing read!! insightful and informative article.

Hi, nice insights, don't you think for GDP increase though per capita expenditure is what matters the most...as Indians we are known for hoarding money...what do you think about this?