Bond Bazaar: Exploring the Market of Fixed Income.

Hello there,

Guess who's back with another edition of the newsletter? That's right, buckle up for a finance adventure that won't make you yawn! In our last edition, we learned about the exciting world of IPOs, where companies go public and give away shares. But hold on, what if you're a founder who wants funding without giving up your precious ownership? that is where the concept of bonds comes in place. Do you know that bonds have a superpower? Yes, it's a known fact that bonds offer higher returns than fixed deposits, but surprisingly, hardly anyone seems to invest in them. why so? let’s deep dive into the realm of bonds and I am sure once you read this newsletter you can easily take decision whether you want to invest in bonds or not.

So what are bonds? Imagine you're the founder of a company and you're seeking funding to fuel its growth. You're faced with two options: taking a bank loan with a hefty 12% interest rate (ouch!) or issuing an IPO, which means relinquishing some of your precious shareholding. But what if you don't want to give up your stake? That's where bonds come in to save the day! Basically company will tell public that see when you keep your money in fixed deposits you get 6% interest in return but what if I tell you that I will pay you 9% interest if you invest that money in my company for next 5 years. Now this sounds fascinating because this is a win win situation for both company and public as company will get funding on low interest because if they would have borrowed money from the bank they would have paid 12% interest so straight up there’s saving of 3%. and for public they are getting extra return of 3% on their investment.

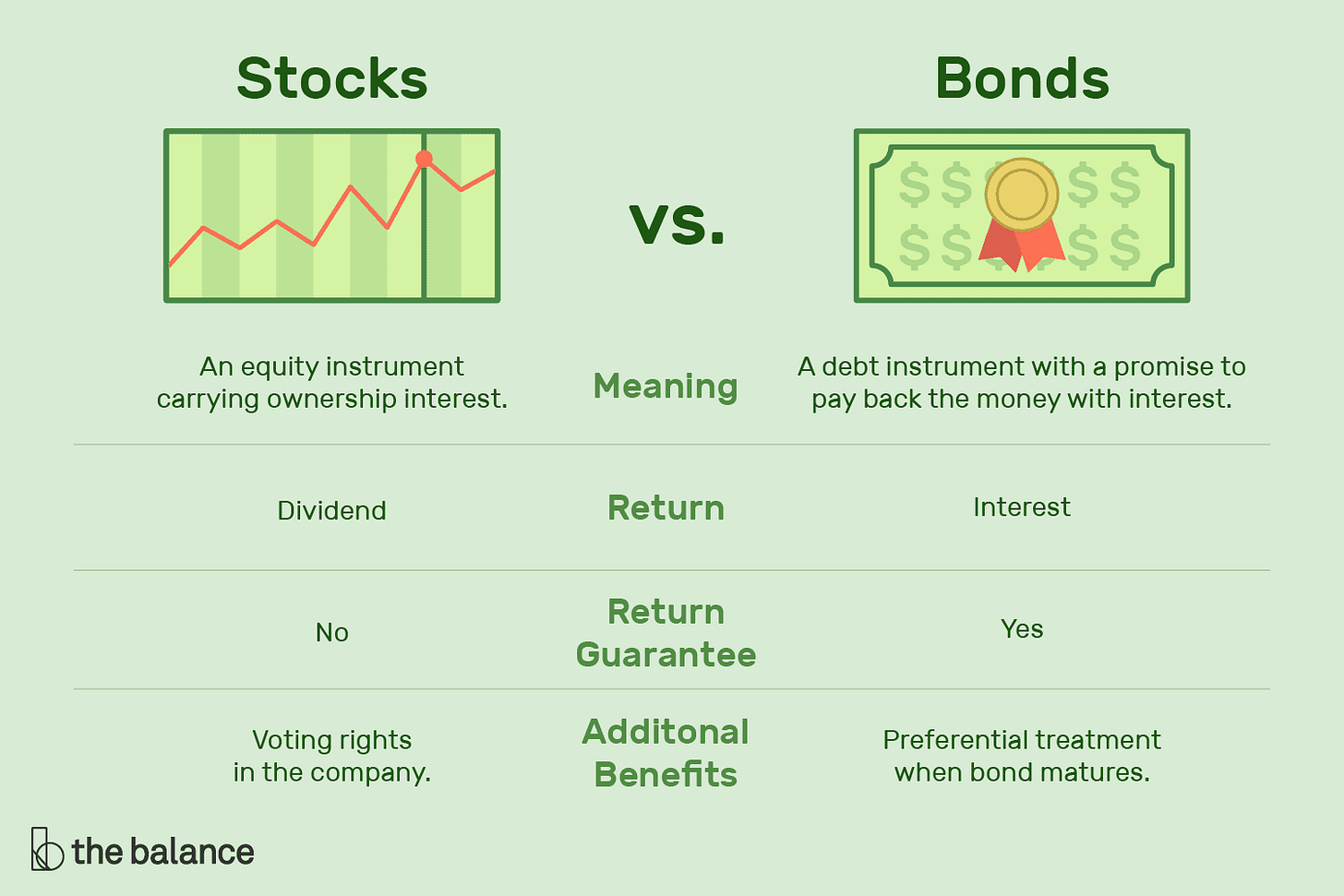

Here’s a quick difference between Stocks and Bonds:

Let's dive into some key terminologies you'll encounter when dealing with bonds. First up, we have the face value! This is the price at which a company initially offers its bonds to the public.

Next, we have the coupon rate. Don't worry, it's just a fancy term for the interest you earn on your investment. Let's break it down with an example. Imagine a company is issuing bonds with a face value of Rs 1000 and a coupon rate of 10%.

In this case, if you buy one bond worth Rs 1000 at a 10% interest rate, you'll earn Rs 100 as interest at the end of each year for the next 5 years. So, the face value of the bond is Rs 1000, and the coupon rate is the 10% interest you'll receive on your investment.

Let me clarify the most important point for you to understand: the company will always pay interest based on the face value of the bond.

To explain this, let's take an example with Reliance. In 2022, they issued bonds with a face value of Rs. 1000 and a coupon rate of 10%. So, if you had bought one bond, you would have earned Rs. 100 as interest.

Now, in 2023, Reliance issued new bonds with the same face value of Rs. 1000, but this time with a coupon rate of 8%. You might think it's foolish to buy the 8% bond instead of the 10% bond because you would lose out on the extra 2% interest. So, you decide to buy the 10% bond from someone who already owns it and wants to sell.

Here's where things get interesting. Many others have the same idea as you, which increases the demand for the 10% bond. As a result, the price of the bond goes up. So, if you want to buy the same 10% bond now, you might end up paying Rs. 1200 instead of Rs. 1000 because of the high demand.

But remember, "company will always pay interest on the face value." So even though you paid Rs. 1200 for the bond, you will still receive interest based on the original face value of Rs. 1000, which is Rs. 100 and this brings me to the last terminology which you need to understand it’s called “Yield to maturity.”

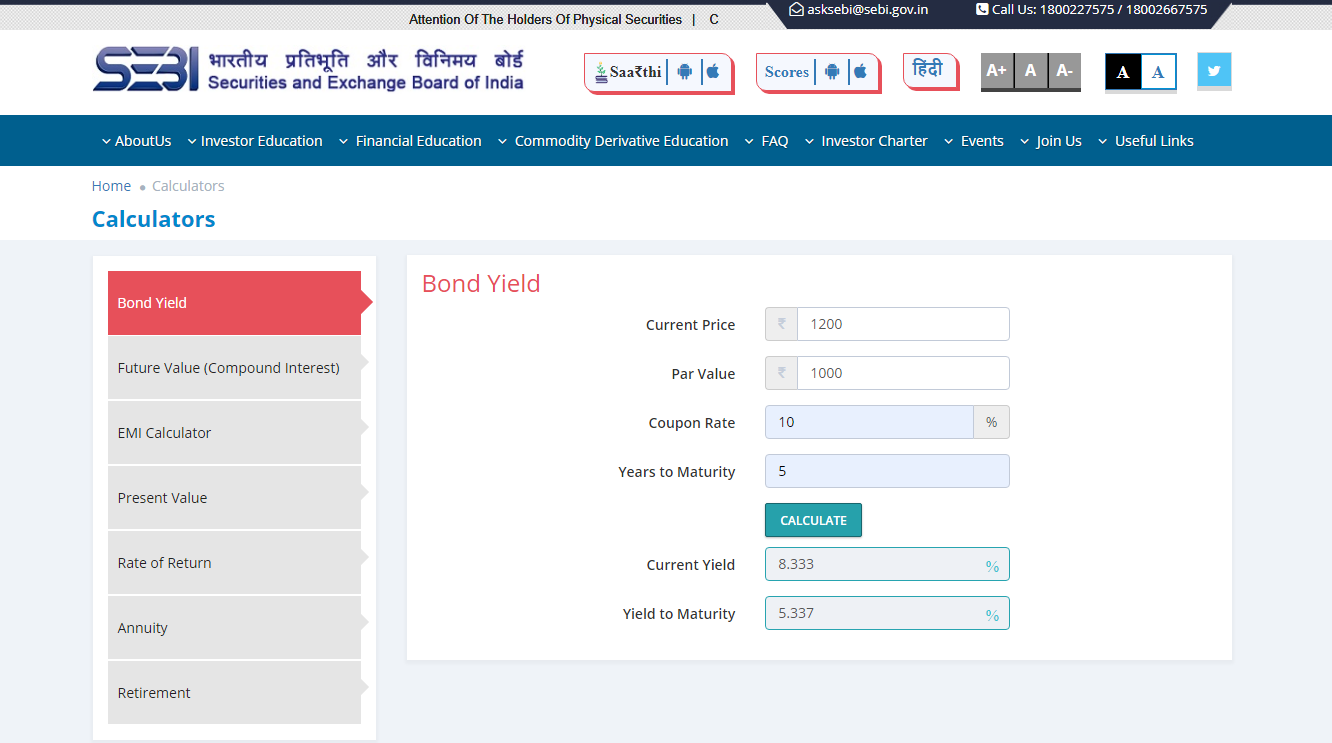

Yield is basically the actual interest you’re earning on your investment like in our example only even tho you paid 1200 for bond you can’t tell you are earning 10% because actual earning on your investment is 8.3% [(100/1200)*100)].

it’s complicated right? don’t worry you don’t have to calculate this manually there is a website of SEBI where you can easily calculate all these numbers easily.

here’s the link: https://investor.sebi.gov.in/calc/calculators.html

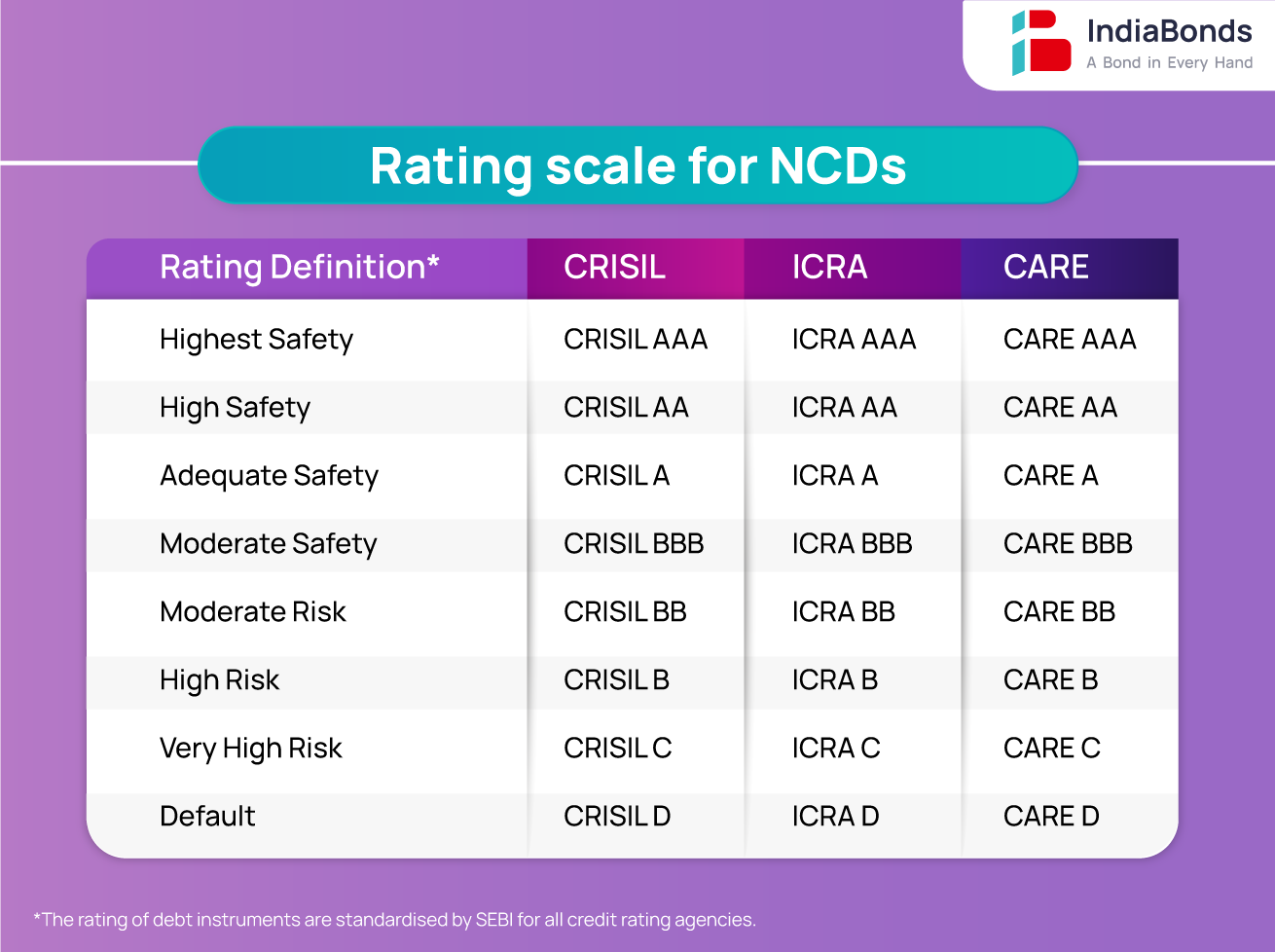

Now, let's delve into an important aspect of bond investments - measuring risk. When you purchase a bond, it comes with a credit rating assigned to it. This rating indicates the level of risk associated with that particular bond. The credit rating helps investors assess the safety and reliability of the bond.

Check out the image below to understand the credit rating system used by different organizations and the corresponding values assigned to each rating.

Remember, higher-rated bonds are generally considered less risky, while lower-rated bonds carry more risk. Credit ratings can be a helpful tool for investors to evaluate the level of risk associated with a bond before making an investment decision.

Now, let's ponder on a question that requires some thought. We have discussed corporate bonds issued by private companies, but let's shift our focus to government bonds. You have two options: Central Government Bonds offering a 10% interest rate at a face value of Rs. 1000, and State Government Bonds also offering the same 10% interest rate at a face value of Rs. 1000. Both bonds have a AAA rating, indicating the highest level of creditworthiness.

While it may seem obvious to choose the Central Government Bonds, I want you to think beyond the assumption that the central government cannot fail. Recent events have shown that governments can face challenges, such as the fall of the government in Afghanistan and the economic struggles faced by Sri Lanka and Pakistan.

So, what could be the one reason that sets Central Government Bonds apart from State Government Bonds? Can you identify that one key factor that provides an unparalleled level of assurance, ensuring that even if the government were to face a crisis, your invested money would still be returned to you without fail?

Feel free to share your perspective in the comment section below. I'm excited to read your thoughts and insights on this topic. If you prefer a more private discussion, you can send me a personal message. Don't worry if you're a bit shy, I completely understand.

Phew! After diving deep into the world of bonds, it's time to switch gears and move on to our favorite segment: movies!

The movie which I want you to watch is T-34. it’s war movie. Now When I mention that "T-34" is a war movie, you might naturally assume it's filled with guns and bombs. However, this film breaks the mold, as it showcases minimal use of firearms and instead focuses solely on tanks. Prepare to witness some of the most incredible tank battles ever depicted on screen. Trust me, the director's skillful shots will leave you in awe. Don't miss out on this masterpiece – make sure to catch it this weekend!

I stumbled upon this hilarious Twitter thread that I believe everyone should check out. Trust me, it's worth a watch and guaranteed to put a big smile on your face. here’s the link : Click me

Recently rewatched the incredible movie "Whiplash" and was completely in awe. It got me thinking about the best drummers in the music industry, and one name immediately came to mind: Travis Barker. His talent behind the drums is simply mind-blowing. If I had to pick one song that showcases his exceptional drumming skills, it would be "She's Really Out of Her Mind" by Blink-182. The drum beats in that song are absolutely insane! It's a fresh and energetic track that never fails to get you pumped up.

And that's a wrap for this edition. I hope you've enjoyed the world of the bond market. I’ll see you next week with an interesting Case study.

In the meantime, take a break, enjoy your weekend, and keep those motivational engines running. Stay inspired, keep moving forward, and remember, life's just one big blockbuster movie waiting to unfold. See you next time, and until then, go out there and make your own Hollywood-worthy story!

Central Government Bonds and State Government Bonds are kinda different, The main thing that sets them apart is the level of credit risk. Central Government Bonds are seen as safer 'cause the national government has more moolah and can handle its financial obligations, even during tough times. State Government Bonds, on the other hand, have a higher risk 'cause states have a smaller revenue base and can be influenced by local factors. So, if you want that extra assurance, go for Central Government Bonds, dude. They've got your back, even in a crisis.