Hello there,

Recently one of my close friend decided to buy a house, while some of my friends living in the abroad opted for renting. As I watched from the sidelines with my trusty spreadsheet, I couldn't help but wonder: which is the smarter move for long-term wealth-building? So, like any good researcher with too much time on their hands, I dove headfirst into the rabbit hole of real estate data and expert opinions. And let me tell you, it was a wild ride full of surprises and questionable puns.

In this edition of our newsletter, we're tackling the eternal question: should you buy a house or keep renting? We've got some insightful articles, some humorous takes, and even some expert advice to help you figure out what's best for you and your wallet

To make things easy I have made a model figuring out the Factors one should keep in mind before getting into buying vs renting, it is called the H.O.U.S.E. rule:

H: Hidden Costs - When it comes to buying a home, it's important to consider the hidden costs that often come with it. These can include closing fees, property taxes, home inspections, and repairs. All of these can add up and affect your overall budget, so it's important to account for them before making a final decision.

O: Opportunity Cost - Consider what you could do with the money you would be investing in a home. Would you be able to use it for other investment opportunities, such as stocks or starting a business? While owning a home can build equity and provide long-term financial benefits, it may not be the best choice for everyone's financial situation.

U: Upkeep and Maintenance - Homeownership comes with responsibilities and expenses for maintenance and upkeep. You may need to hire professionals for repairs or upkeep, or you may choose to do it yourself. Consider whether you have the time, resources, and skills to handle these tasks and factor those costs into your budget.

S: Stability vs. Flexibility - Owning a home can provide a sense of stability and security, but it can also limit your options if you need to relocate for work or personal reasons. Renting can offer more flexibility and mobility, but it may lack the stability and permanence that owning a home can provide.

E: Ease of Living - The ease of living in a particular home or rental should be considered. Does it fit your lifestyle and preferences? Does it have the necessary amenities and features you need to live comfortably? Is it in a desirable location?

This thumb rule provides a helpful framework for considering the factors to weigh before making a decision. However, when it comes to finances, the opportunity cost is a crucial factor to consider.

Opportunity cost is the benefit that you give up when you choose one option over another. In other words, it's the value of the next best alternative that you forego when you make a decision. Let's say you have a free weekend and you have two options for how to spend your time: you could go to a music concert with your friends, or you could stay home and catch up on some work.

If you choose to go to the music concert, the opportunity cost is the value of the work that you could have completed during that time. This could be the opportunity to earn more money, complete a project that could lead to career advancement, or simply the satisfaction of crossing something off your to-do list.

On the other hand, if you choose to stay home and work, the opportunity cost is the enjoyment and social connection that you could have gained from attending the music concert.

In both scenarios, there are trade-offs involved and you are giving up something valuable when you choose one option over the other.

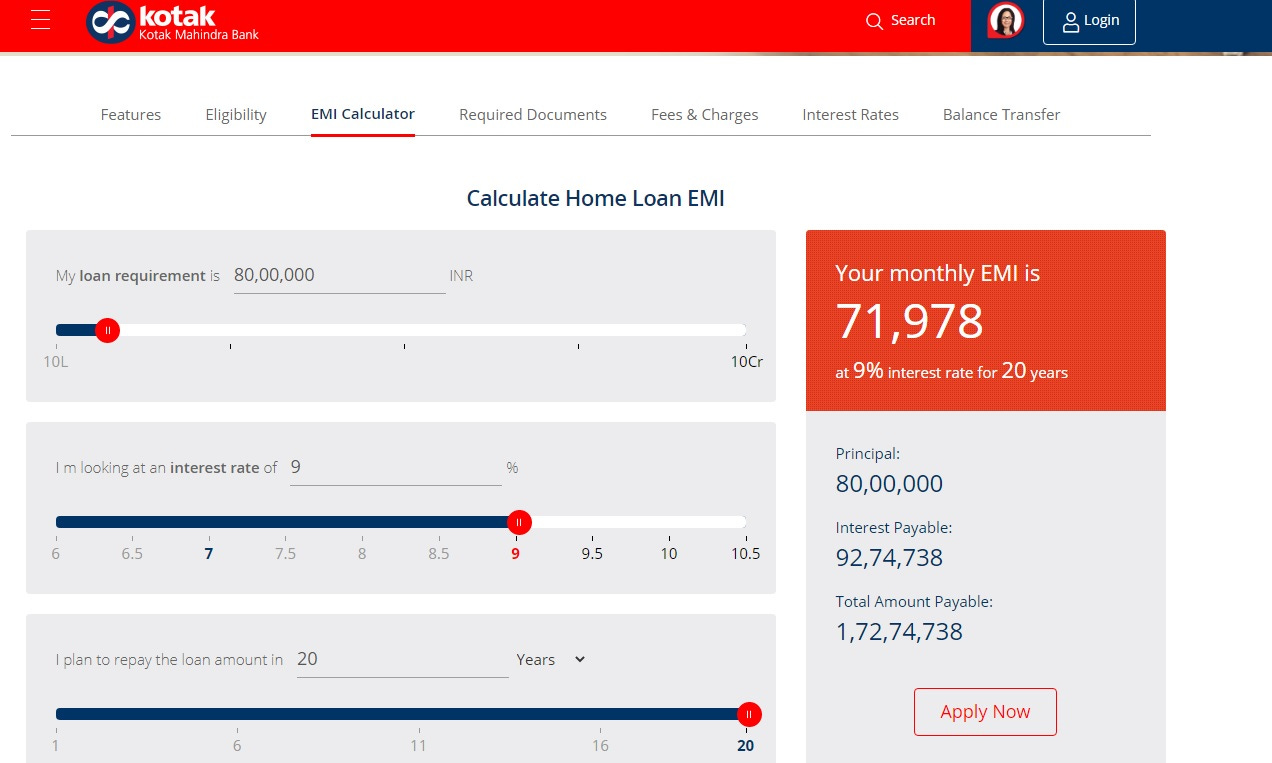

Let's say you've set your sights on a dream house worth INR 1 crore. If you make a down payment of 20%, or INR 20,00,000, you'll need to take a loan of INR 80,00,000 from a bank at 9% p.a. over a period of 20 years. With a monthly installment of INR 71,978, you'll be able to pay off your loan in 240 months.. I have utilized Kotak's website to estimate my home loan EMI. If you want to calculate your home loan EMI based on your requirements, here's the link to the website.

https://www.kotak.com/en/personal-banking/loans/home-loan/home-loan-emi-calculator.html

When considering the decision to rent or buy a house, it's important to think about the opportunity costs of each option. One key question to ask is what you would do with the money if you didn't use it for a down payment on a house or pay rent. Would you invest it in stocks, cryptocurrency, or another investment opportunity? Additionally, it's important to consider which option would be more financially advantageous in the long run. Would buying a house appreciate in value more than investing the money elsewhere or renting a property? By considering these factors, you can make an informed decision that aligns with your financial goals and maximizes your returns.

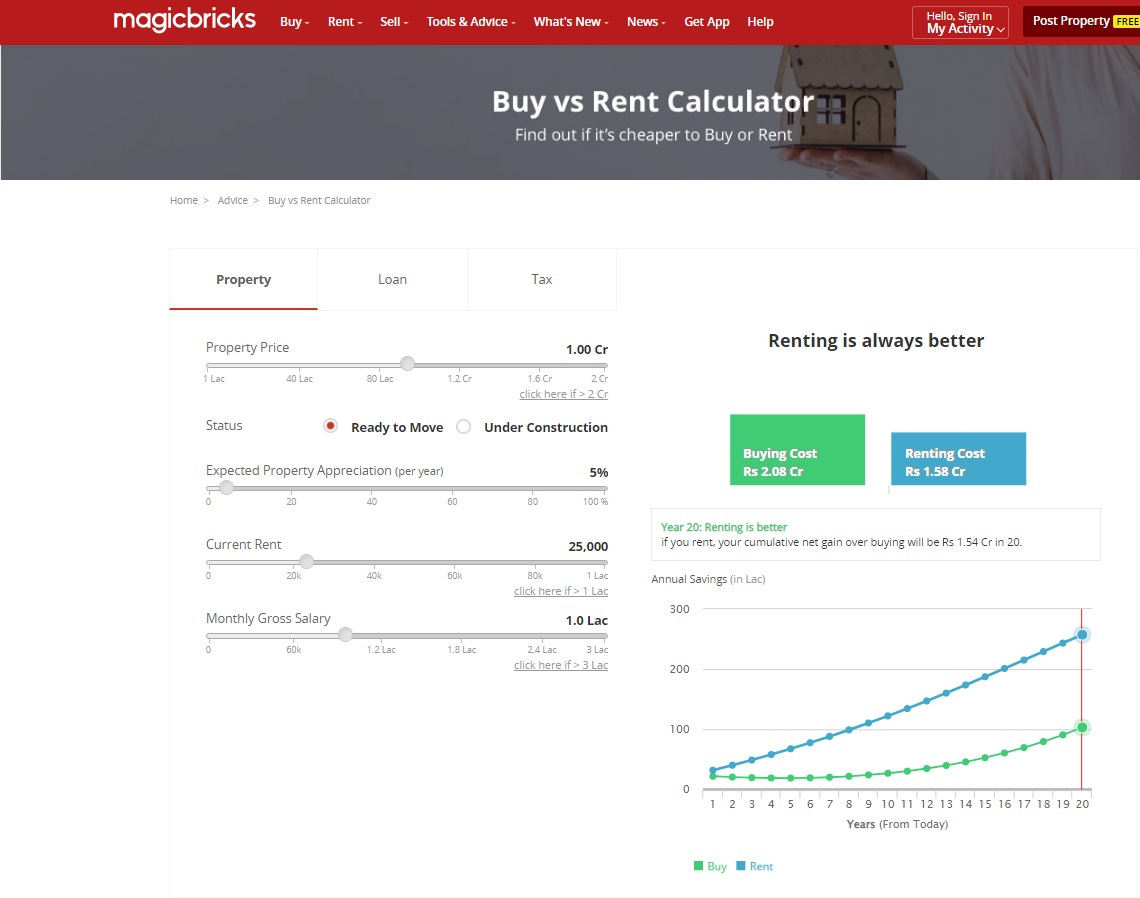

Alright, all of this is pretty abstract. So let's try running the numbers using this cool rent versus buy model that the company Magic Brick has built, which calculates, whether we'll have more wealth in 20 years depending on if we buy, or if we rent And this is a pretty cool thing that you can use on your own if you want to. Basically what you can do is you can set all of the parameters that you care about when you're buying and all the parameters that you care about when you're renting.

Let's explore two scenarios. In scene 1, you're buying a house worth INR 1 crore with a down payment of 20%, an interest rate of 9% p.a, and a loan tenure of 20 years. In scene 2, you're renting the same property where the property appreciation is 5%, and you pay a monthly rent of INR 25,000, which is 25% of your assumed salary of INR 1,00,000. Let's see how these scenarios stack up. :

Based on the example we have analyzed, it appears that renting a property may yield more financial benefits over a 20-year period compared to buying a house. You can try using the model provided in the link to input your own data, such as your salary and expected appreciation rate of the property. This will allow you to make an informed decision that suits your individual financial situation.

The key takeaway from this discussion is that one should not blindly believe the popular notion that buying a house is always a better financial decision than renting. It's important to crunch the numbers yourself based on your unique circumstances and preferences. However, it's worth noting that while calculators can provide a helpful analysis of the financial aspects, they may not account for the emotional factors that come into play when making a decision about where to live.

When it comes to buying a home, psychological factors play an important role in the decision-making process. People tend to form emotional connections with their homes, which can be influenced by a range of factors such as personal values, social status, family history, and cultural background. The desire for stability, security, and a sense of belonging can also influence the decision to buy a home.

Humans are social animals, and our need for social connection can also play a role in the decision to buy a home. Having a place to call our own can provide a sense of identity and belonging, both within our families and our larger communities. In addition, homeownership can be seen as a marker of success and status, which can further reinforce our emotional attachment to our homes. Ultimately, buying a home is not just a financial decision, but a deeply personal and emotional one.

WHAT YOU SHOULD DO:

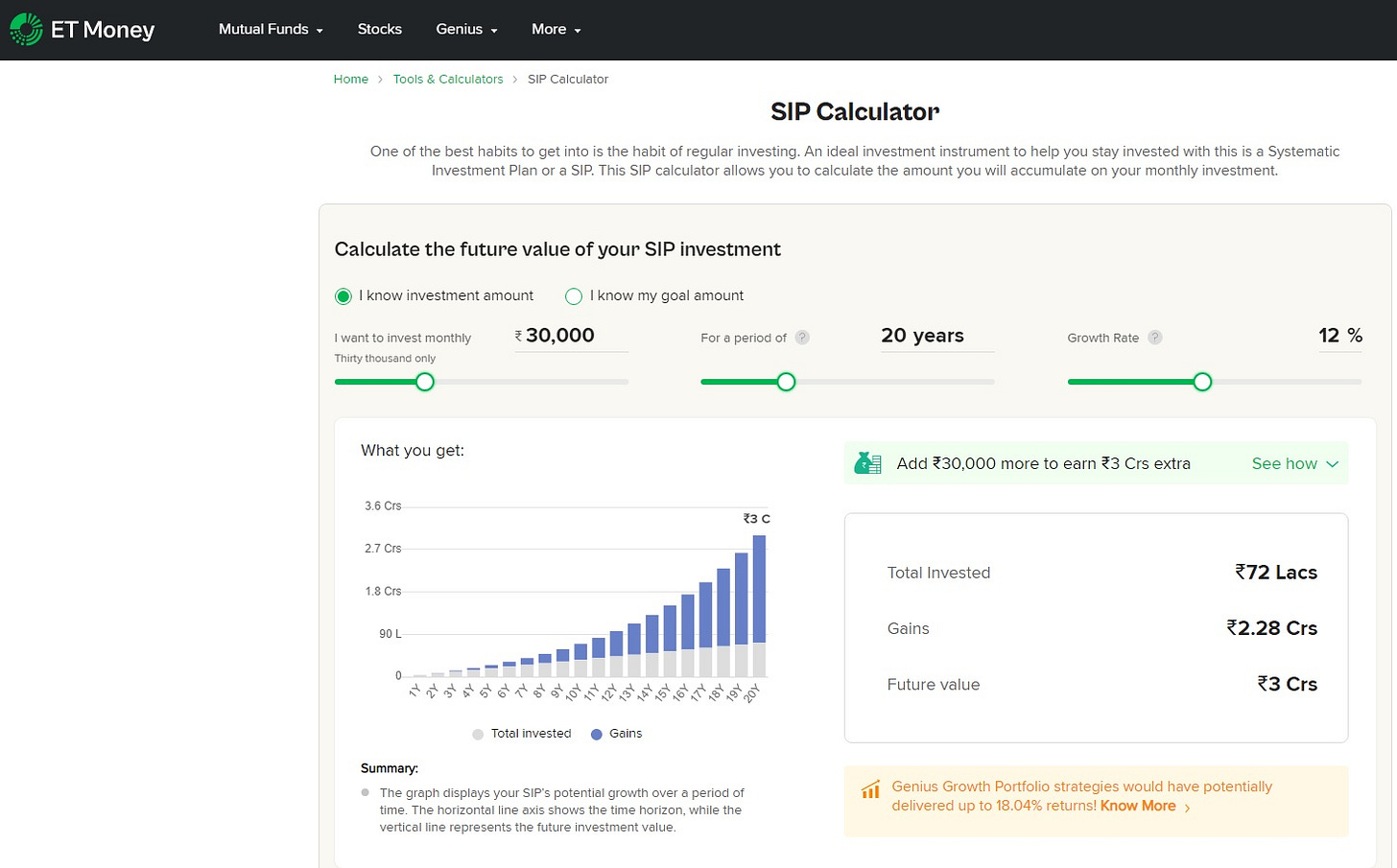

Important point to consider is that if you commit yourself to paying high EMIs on a home loan in your 20s, you may miss out on the opportunity to invest in stocks or mutual funds. This could lead to losing the benefits of compounding, which is the ability to earn interest on your principal amount as well as on the interest earned over time. By investing early and regularly, even with small amounts, you can benefit from the power of compounding and potentially accumulate a significant amount of wealth over time. Therefore, it's crucial to strike a balance between paying EMIs and investing in stocks or mutual funds to achieve your financial goals in the long run. Taking a well-thought-out approach towards investing can help you create a strong financial foundation and prepare you for a secure future.

Investing in your 20s can be a wise decision that can set you up for a secure financial future. By renting out a property and investing in SIPs of INR 30,000 with a 12% annual return for 20 years, you can accumulate a significant amount of wealth that can be used to purchase your own home in your 40s. This strategy not only helps you to secure a place to call your own but also provides a sense of financial security and stability for your future.

SIP calculator link: https://www.etmoney.com/tools-and-calculators/sip-calculator

In your 30s and 40s, you may have more financial stability and a clearer idea of your long-term goals, including retirement. This is the time when buying a home could be a wise investment for your future. By purchasing a home, you are building equity and an asset that can potentially appreciate in value over time. This could help secure your retirement by providing you with a valuable asset that could be sold or used to generate rental income.

Moreover, owning a home can provide a sense of stability and permanence, which can be particularly important if you have a family. It can also give you the freedom to customize and personalize your living space without worrying about a landlord's restrictions.

Speaking of renting, it's like that guy who nailed the Google interview but couldn't even pass the tenant interview in Bangalore. I kid you not, this actually happened!

Here’s the full story:

In conclusion, whether to buy or rent a home depends on individual circumstances and priorities. Renting provides flexibility and can be a good option for those who prioritize mobility or don't want to commit to a long-term investment. On the other hand, buying a home provides stability, a sense of ownership, and can serve as a long-term investment. However, it's important to consider factors such as affordability, financial goals, and lifestyle before making a decision. Ultimately, it's up to each person to weigh the pros and cons and make the choice that aligns with their goals and values.

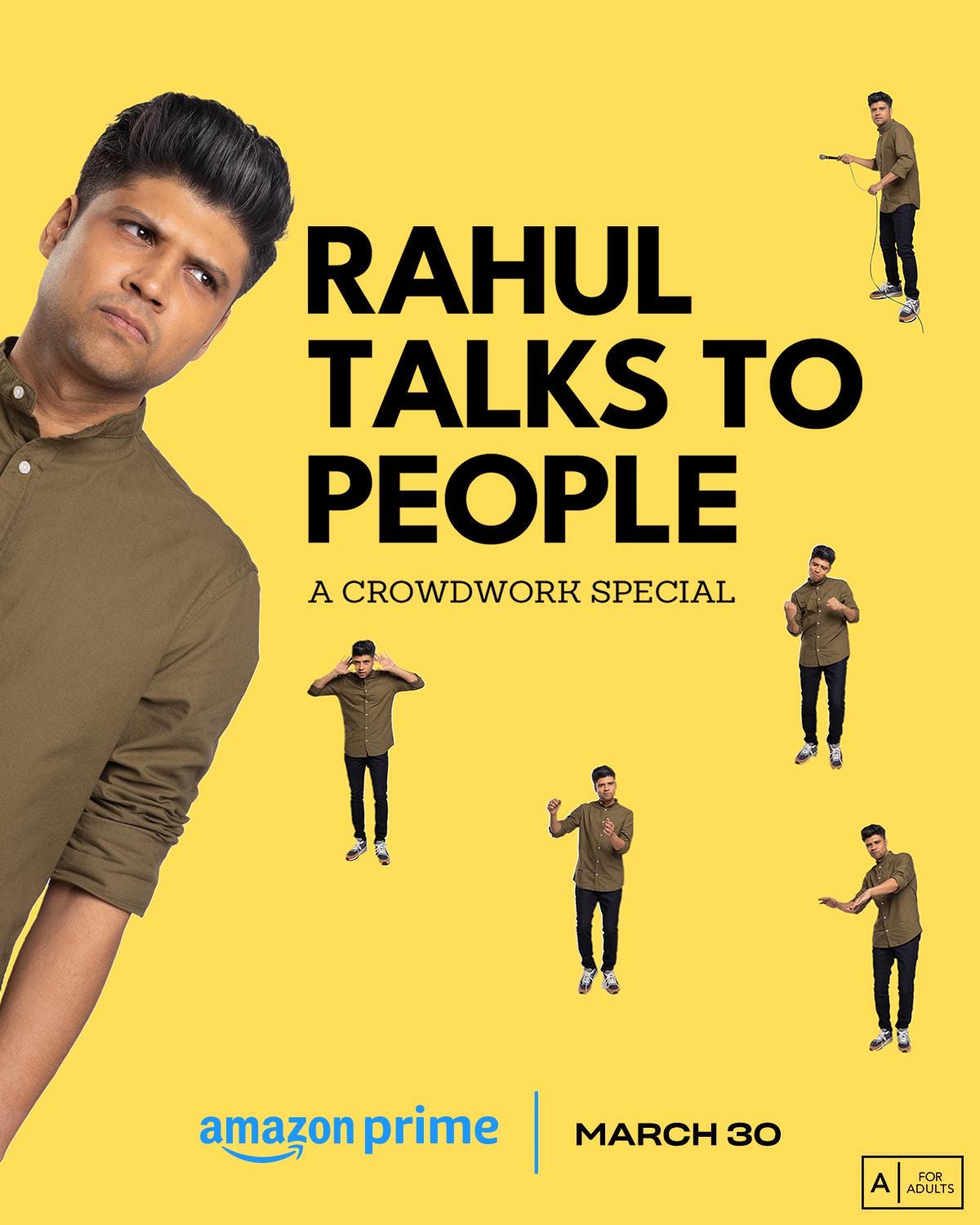

Let's shift our focus from housing and delve into the world of entertainment - movies. But before I share my top movie picks, I must recommend a side-splitting stand-up comedy special by Rahul Subramanian that I recently watched. The crowd work was impressive and had me in stitches throughout. Do give it a watch if you're looking for some comic relief.

And while you're at it, why not pair it with a classic comedy film “Little miss sunshine” and If you haven't already watched the John Wick series, you're missing out on some of the best action movies ever made. The cinematography in John Wick 4 is outstanding, just like the previous movies, with breathtaking action scenes and visually stunning moments that will leave you in awe.

As we come to the end of this newsletter, I hope you found the discussion on buying versus renting a home helpful in making informed decisions about your financial future. Remember to prioritize your long-term goals and plan accordingly. If you ever need additional guidance, don't hesitate to seek the advice of a financial professional. In the meantime, stay curious, keep learning, and never stop growing.

Good one.