Hello there,

Welcome back to the latest edition of my newsletter. It's the last Saturday of the month, which means it's time for an intriguing case study. In our previous edition, we delved into the enchanting world of the bond market. But I left you all with a little riddle. I asked, "What superpower does the central government possess that makes it more enticing to invest in their bonds rather than the state government's?" Ah, the answers came pouring in through personal messages and comments alike. Now, it's time to unveil the true answer— The real answer is... the incredible ability to print money! Yes you have read it right. let’s understand this with an example to get a better understanding:

Now, picture this: you decide to invest in a central government bond worth 1 lakh. It's a safe bet, right? After all, even if the central government were to face some crisis, they have a unique power at their disposal. We just learned that they can simply print more money to repay their debts. However, here's the catch – when they repay you that 1 lakh, it may not hold the same value as it did when you initially invested but you will get your 1 lakh invested amount back. You see, with the increased printing of money and its circulation in the market, the value of that 1 lakh may have changed. So, while you will indeed receive your 1 lakh back, its purchasing power might not be the same as it once was. In today's case study, we're diving deep into the fascinating world of money and exploring the consequences when a government starts printing more of it. We'll take a closer look at how money functions in the market and shed light on a well-known event called the Zimbabwe crisis. This real-life example will help us understand the entire situation better and unravel the effects of excessive money printing. So, get ready for an enlightening journey into the realm of money and its impact on economies.

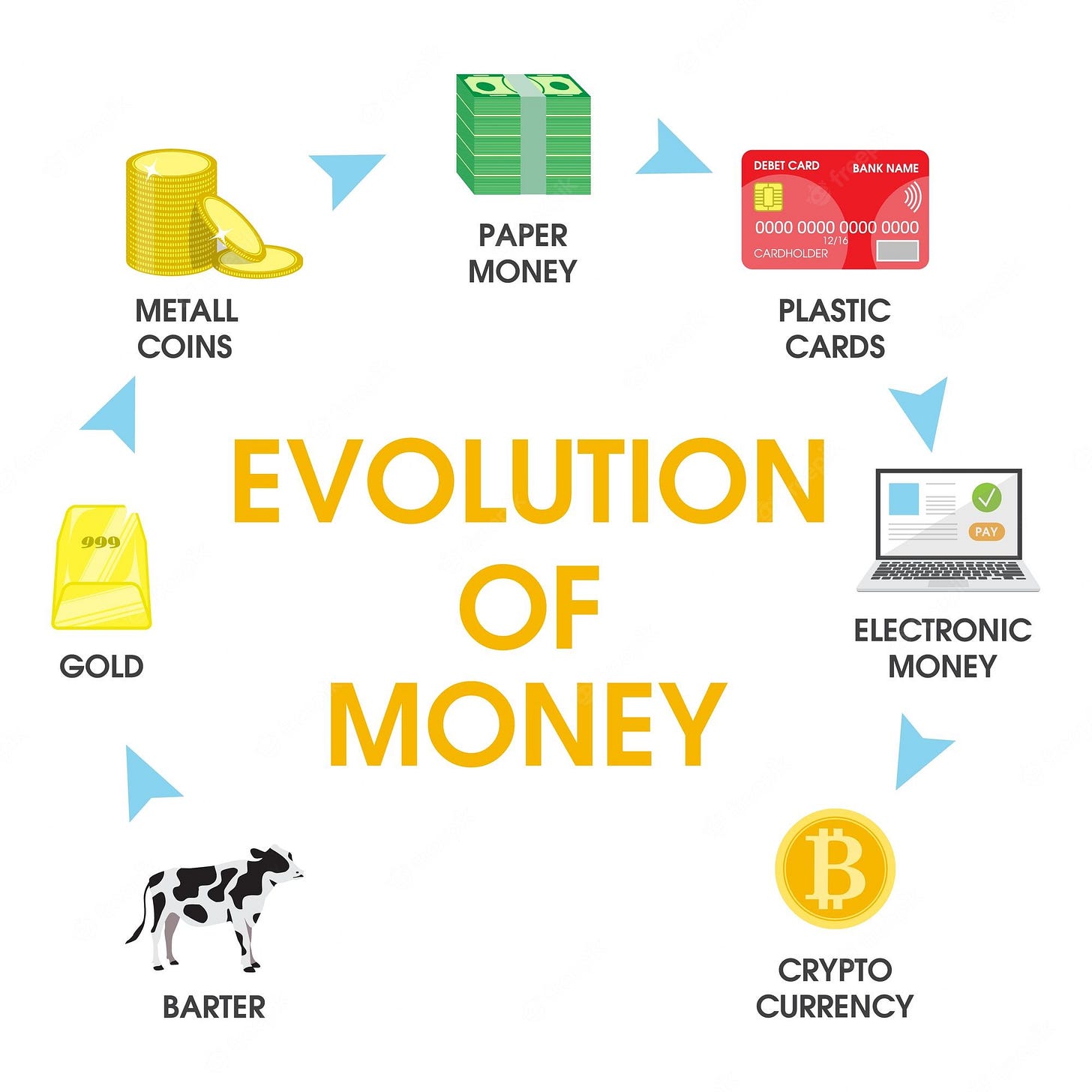

In the realm of economics and finance, everything revolves around the delicate balance of supply and demand for money. But before we dive into that, let's take a moment to understand the essence of money and how it came into existence. In ancient times, people used to engage in a system known as bartering, where goods and services were exchanged directly. For instance, if I gave you 5 kilograms of salt, you would give me 3 kilograms of sugar in return. However, this method often led to confusion and hindered trade.

As society progressed, the concept of using gold as a medium of exchange gained popularity. Gold had inherent value and was widely accepted. Yet, there was a drawback: the security and inconvenience of carrying gold everywhere. To tackle this issue, governments stepped in and offered to safeguard people's gold by storing it securely. In return, the government issued promissory notes to individuals, representing their ownership of a specific amount of gold. These notes served as a promise, assuring the bearer that they could use it for future transactions.

Over time, these promissory notes transformed into the currency notes we use today. It's important to note that paper money, in and of itself, doesn't hold any intrinsic value. Its worth lies in the trust we place in the government's promise. The governor of the Indian central bank, through their signature, signifies the government's commitment to honor the value stated on the note. This promise creates a shared belief and trust among individuals, making the paper money a widely accepted means of exchange.

This leads us to a fundamental conclusion: money equals value. Every event or transaction seems to be intertwined with money. For instance, let's consider the concept of working for a company. When you devote eight hours of your time to the company, you are essentially providing value through your work. In return, the company compensates you monetarily.

Now, let's explore the dynamics of supply and demand through another example. Imagine you want to sell your laptop, and there happen to be 100 interested buyers. Since there is only one laptop available (limited supply) but a high demand from those 100 buyers, you can gradually increase the price until the last person agrees to buy it. As a result of the high demand, your laptop, originally valued at 20,000 rupees in the second-hand market, may end up selling for 30,000 rupees.

Now, let's delve into the concept of printing more money and its impact on prices, also known as inflation, which we discussed in our previous edition. Consider a car manufacturer producing a car worth 1 lakh rupees. Initially, only 100 people have the purchasing power to buy the car, while others settle for bikes or scooters. However, if the government starts printing more money and distributes it among the public, people's purchasing power increases. Consequently, those who previously couldn't afford the car now have more money and join the demand for the same car. As a result, the original 100 people demanding the car multiply to 1000 people. Similar to your experience of selling the laptop at a higher price due to increased demand, the car manufacturer would also raise the price of the car to meet the heightened demand.

This is why we often hear news reports about the skyrocketing prices of essential commodities like onions. The main reason behind such price hikes is the scarcity of supply, prompting people to be willing to pay higher amounts.

And now as you guys have understood the value and demand/supply of the money let’s see discuss the zimababve crisis

Zimbabwe faced some serious economic troubles. To solve their financial problems, the government had a rather questionable idea—they decided to print lots and lots of money. At first, it seemed like a good solution. The government could pay off their debts and cover their expenses easily. But, things didn't go as planned.

As more and more money flooded into the country, something strange started happening. The value of the money began to disappear. It was like magic! Prices went up so fast that it was hard to keep track. Imagine going to the store one day and finding out that the price of a loaf of bread had doubled or even tripled by the next day. People struggled to afford basic things they needed, like food and clothes. It was a really tough time.

To make matters worse, the government had to print bigger and bigger banknotes because the old ones became almost worthless. Can you believe they had banknotes worth trillions of dollars? People had to carry stacks of cash just to buy simple things. It was like living in a crazy world where money didn't mean much anymore.

The reason behind all this chaos was that the government had printed too much money without thinking about the consequences. When there's too much money in circulation and not enough goods to buy, prices go up like crazy. It's like a never-ending cycle that hurts the economy and the people who depend on it.

After enduring the severe economic turmoil caused by hyperinflation, Zimbabwe embarked on a challenging path to recovery. To stabilize the situation, the government took decisive steps, including the abandonment of the Zimbabwean dollar as the official currency. In 2009, the country adopted a multi-currency system, primarily using the US dollar and South African rand for transactions. This move brought stability to prices and restored confidence in the economy.

Alongside Zimbabwe, there are other countries that have faced similar crises, and their inflation rates are truly jaw-dropping. Feast your eyes on this list of countries with the highest inflation rates in recent years.

Take a moment to absorb the shocking numbers before you. As we discussed earlier, remember how a simple cup of coffee costing 100 rupees with a 5% inflation rate meant you'd pay 105 rupees the following year? Well, brace yourself as you mentally engage with the data before you. Put yourself in the shoes of those affected and let the gravity of the situation sink in. Imagine the terror of prices soaring at rates beyond comprehension, and you'll realize just how terrifying hyperinflation can be.

In conclusion, the world of money and inflation can be quite perplexing and even a little scary at times. We've explored the Zimbabwe crisis and discovered how printing excessive money can lead to mind-boggling inflation rates. And let's not forget the other countries that have faced similar challenges. So, the next time you hear about inflation, just remember our trusty cup of coffee and how its price can go up faster than you can say "double espresso." It's a reminder to keep an eye on the economy, embrace fiscal responsibility, and appreciate the value of a stable currency. After all, in this wild world of finance, a little knowledge can go a long way.

That’s it for now if you enjoyed delving into this fascinating case study on the consequences of printing excessive money, don't forget to show your appreciation by leaving a like! So, go ahead, give us a thumbs-up if you found this edition thought-provoking and enlightening. In the meantime, keep that smile on your face, nurture your curiosity, and stay motivated on your journey. Remember, happiness thrives in a curious mind, and motivation fuels your path to success.

thoughtful, great read!

Good Insights, with this context just think of the consequences if FED does what Zimbabwe did, end of the world!

The thought is superficial but, if you see to some extent the FED is doing it rn